What is Copy Trade ?

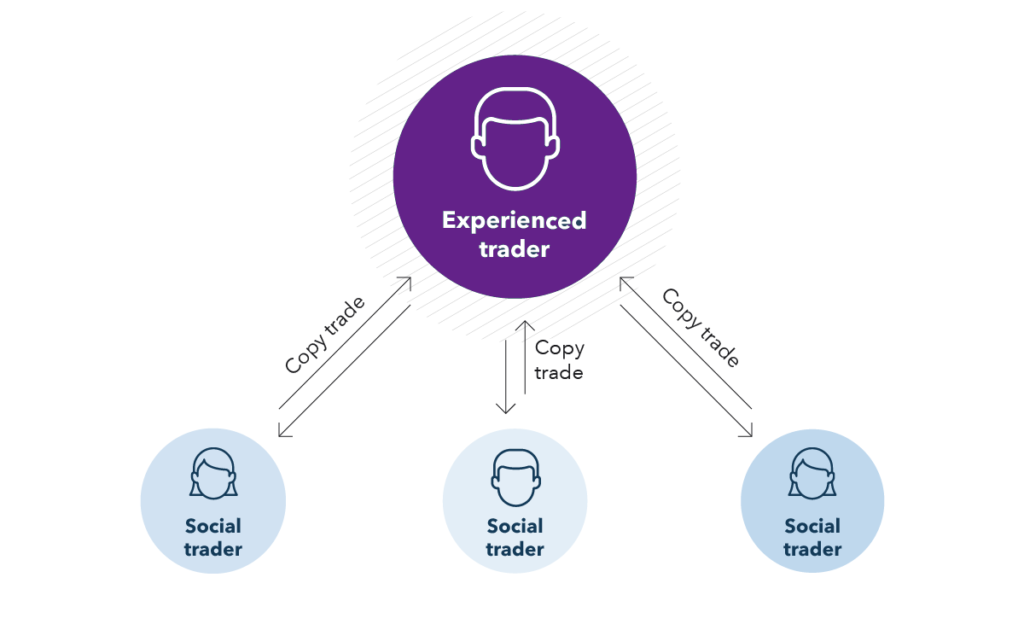

Copy trading enables individuals in the financial markets to automatically copy positions opened and managed by other selected individuals.

One of the simplest ways to take advantage of market opportunity is by copying the best traders. Copy trading allows you to automatically copy the traits that more experienced traders make, without having to analyze the market yourself.

Today, many brokers offer copy trading with a variety of features like CopyFX from ROBOFOREX.

In copy trading, the only research you need to do is to find a profitable trader on a copy trading platform. Most platforms offer a simple way to filter through the trading results of experienced traders, making it easy to find the one that best fits your trading style and risk tolerance.

When a trader that you follow opens a trade, the copy trading platform opens the same trade on your account, automatically. You may also choose how much of your capital you want to allocate to a trader, as well as your total risks per trade.

For example, if a trader opens a buying position on gold with 5% of his trading account size, the same trade would appear in your trading account. You may limit the risk per trade to any level you want in case you’re more risk-averse than the trader you follow.

What are the pros and cons of copy trading?

Copy trading sounds fantastic – you automatically replicate the trades of professional traders without much work and get to enjoy the trading results. However, most of the time, there is no free lunch in the markets. Here are the main pros and cons of copy trading.

Pros:

- Automated trading: The main advantage of copy trading is the ability to automate your trading by following other profitable traders. The only effort you need to make is to find a profitable trader with good trading results, and periodically review the performance of the trader.

- Finding traders: This leads us to the next advantage of copy trading – the simplicity of finding a profitable trader. Most copy trading platforms allow you to filter through different metrics on their website, including trading results, profit & loss, the average size of winning and losing trades, average risk per trade, reward-to-risk ratios, and more.

- No emotions: better trading: If you’re new to trading, you may have experienced that emotions can have a big impact on your trading results. With copy trading, emotional trading becomes a thing of the past. Since you don’t have to analyze the market and trade on your own, there are no emotions involved.

Cons:

- The (in)ability to control risk – As you may guess, the main drawback of copy trading is that your trading performance is completely dependable on the trading results of the traders you follow. If they make a bad trade, that bad trade will also appear in your trading account. To bypass this major drawback, copy trading platforms allow you to set how much you want to allocate to any single trader, and to pre-determine how much you want to lose on any single trade. You can also interfere and manually close a trade if you feel that the copied trade isn’t as good as it could be.