What Is Leverage?

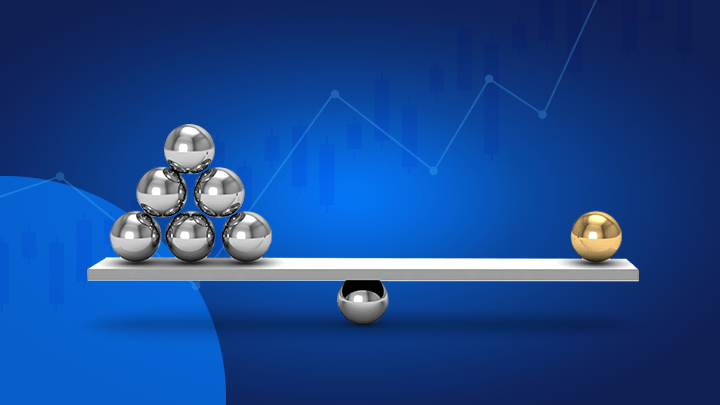

Leverage is nothing more or less than using borrowed money to invest. Leverage can be used to help finance anything from a home purchase to stock market speculation. Businesses widely use leverage to fund their growth, families apply leverage—in the form of mortgage debt—to purchase homes, and financial professionals use leverage to boost their investing strategies.

What is leverage in forex?

Leverage in forex is a way for traders to borrow capital to gain a larger exposure to the FX market. With a limited amount of capital, they can control a larger trade size. This could lead to bigger profits and losses as they are based on the full value of the position.

Trading with leverage in forex, which is also referred to as forex margin, means you can magnify profits if markets move in your favor; however you can also lose all of your capital should markets move against you. This is because profits and losses are based on the full value of the trade, and not just the deposit amount.

Forex trading comes with some of the lowest margin rates in the financial markets. The leverage difference between forex and stocks, for example, is much higher. Stock market leverage starts at around 5:1, which makes trading within the share market slightly less prone to capital risk.

Leverage and margin in forex

Margin is the amount of money needed to open a leveraged trade. When trading forex on margin, you only need to pay a percentage of the full value of the position, which acts as a deposit. Margin requirements can differ between brokers, but start at around 3.3% for the most traded currency pairs, such as EUR/USD, USD/JPY and GBP/USD.

What does a margin call mean in forex?

Any deposits used to keep positions open are held by the broker and referred to as ‘used margin’. Any available funds to open further positions are referred to as ‘available equity’ and when expressed as a percentage, ‘margin level’.

A margin call occurs when your margin level has dropped below a pre-determined value, where you are at risk of your positions being liquidated. Margin calls should be avoided as they will lock in any of the trader’s losses, hence the margin level needs to be continuously monitored. Traders can also reduce the chance of margin calls by implementing risk management techniques.

Risks of leverage in FX trading

As much as leverage trading can be seen as a way to increase your forex profits, it also magnifies your risks. For that reason, having an effective risk-management strategy in place is essential for using leverage in forex. High leverage forex brokers usually provide key risk management tools, including the following list, which can help traders to manage their risk more effectively.

Summary

While margin is the deposit amount required to open a trade, leverage is capital borrowed from the broker in order to gain exposure to larger trading positions. Therefore, forex trading on margin enables traders to open larger positions with relatively small deposits. It is important to remember that trading on leverage can be risky as losses, as well as profits, are amplified.